The MDAX landlord prints stable cash earnings, lowers leverage, and opens a new pathway for value creation via selective data‑centre conversions.

Executive Summary

Aroundtown SA (AT1) reported a steady first half of 2025: recurring cash metrics were broadly stable, leverage improved, and the company refinanced at meaningfully lower coupons. On the same day, management flagged initial grid capacity allocations for several planned data centres in Berlin—an early but notable step in repurposing parts of the office portfolio. The combination of balance‑sheet progress and asset‑repositioning optionality supports a constructive medium‑term outlook, even as near‑term equity volatility persists.

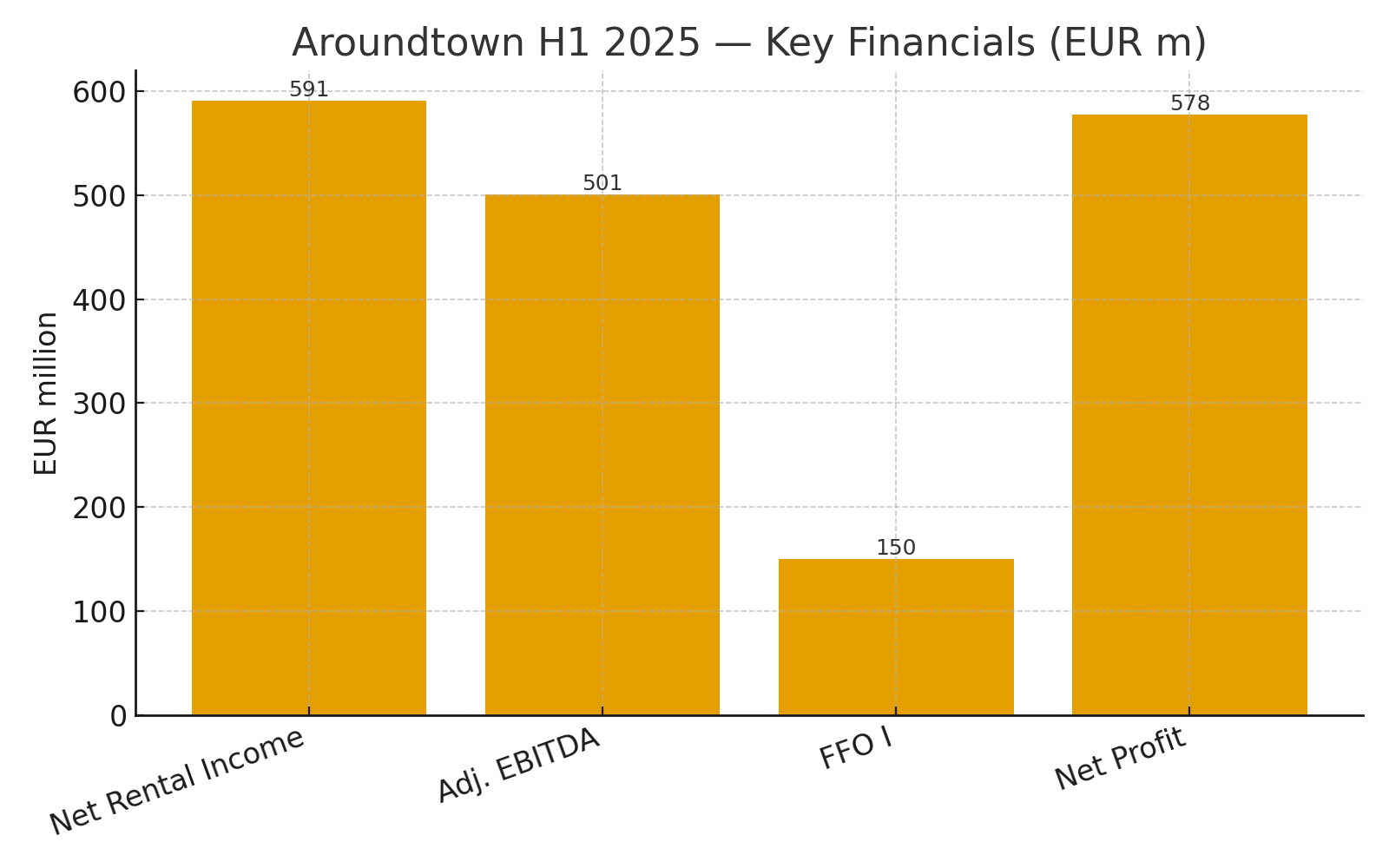

Key H1 2025 Highlights

- Net rental income: €591m, essentially flat year‑over‑year on a like‑for‑like rent increase of ~3% offset by disposals.

- Adjusted EBITDA: €501m, stable versus last year.

- FFO I: €150m (c. €0.14 per share).

- Portfolio revaluation: +1.4% like‑for‑like uplift following a full external appraisal; net profit €578m driven largely by the revaluation.

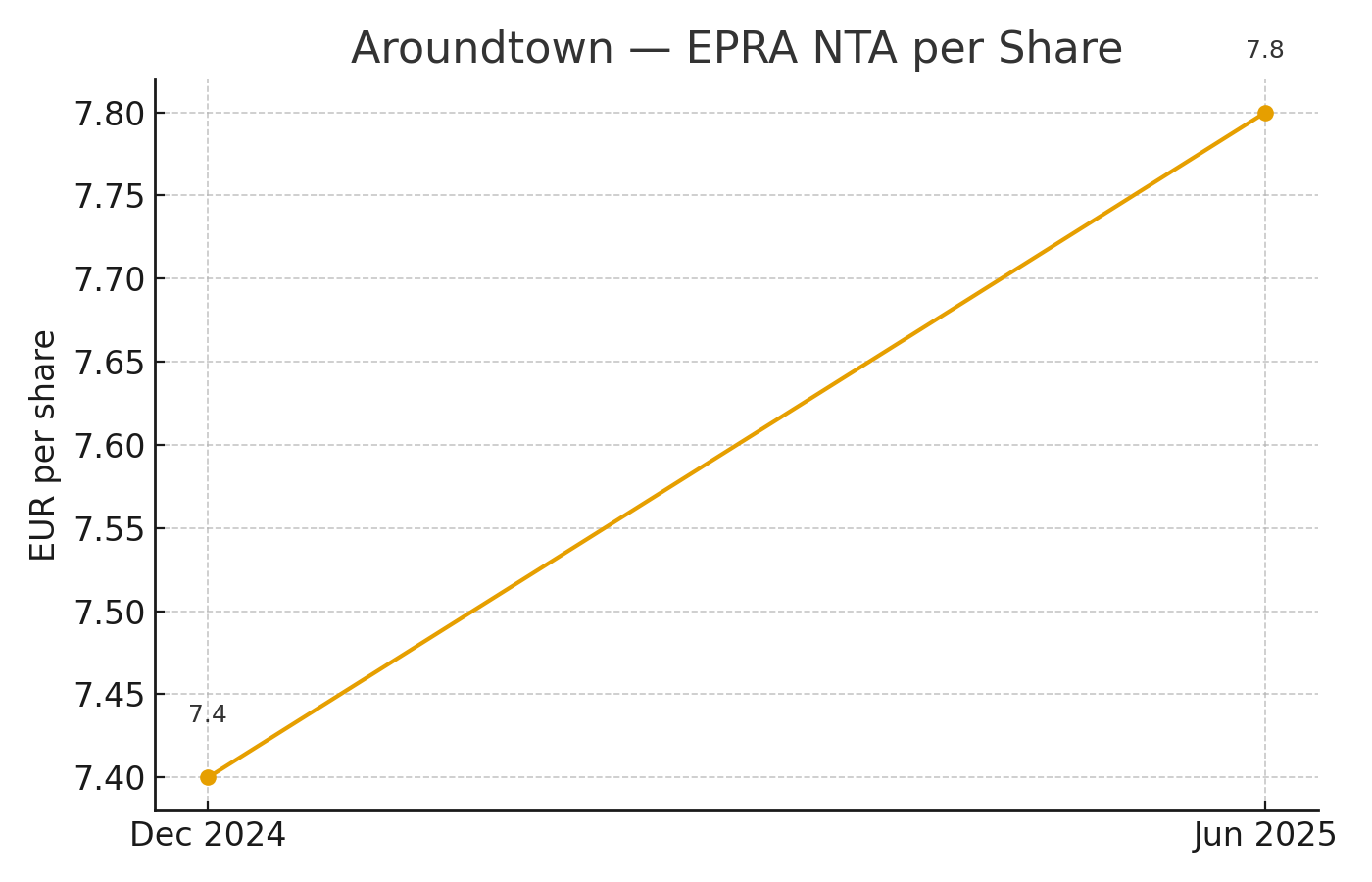

- EPRA NTA: €8.6bn (c. €7.8 per share), up ~5% vs. year‑end 2024.

Balance Sheet & Funding

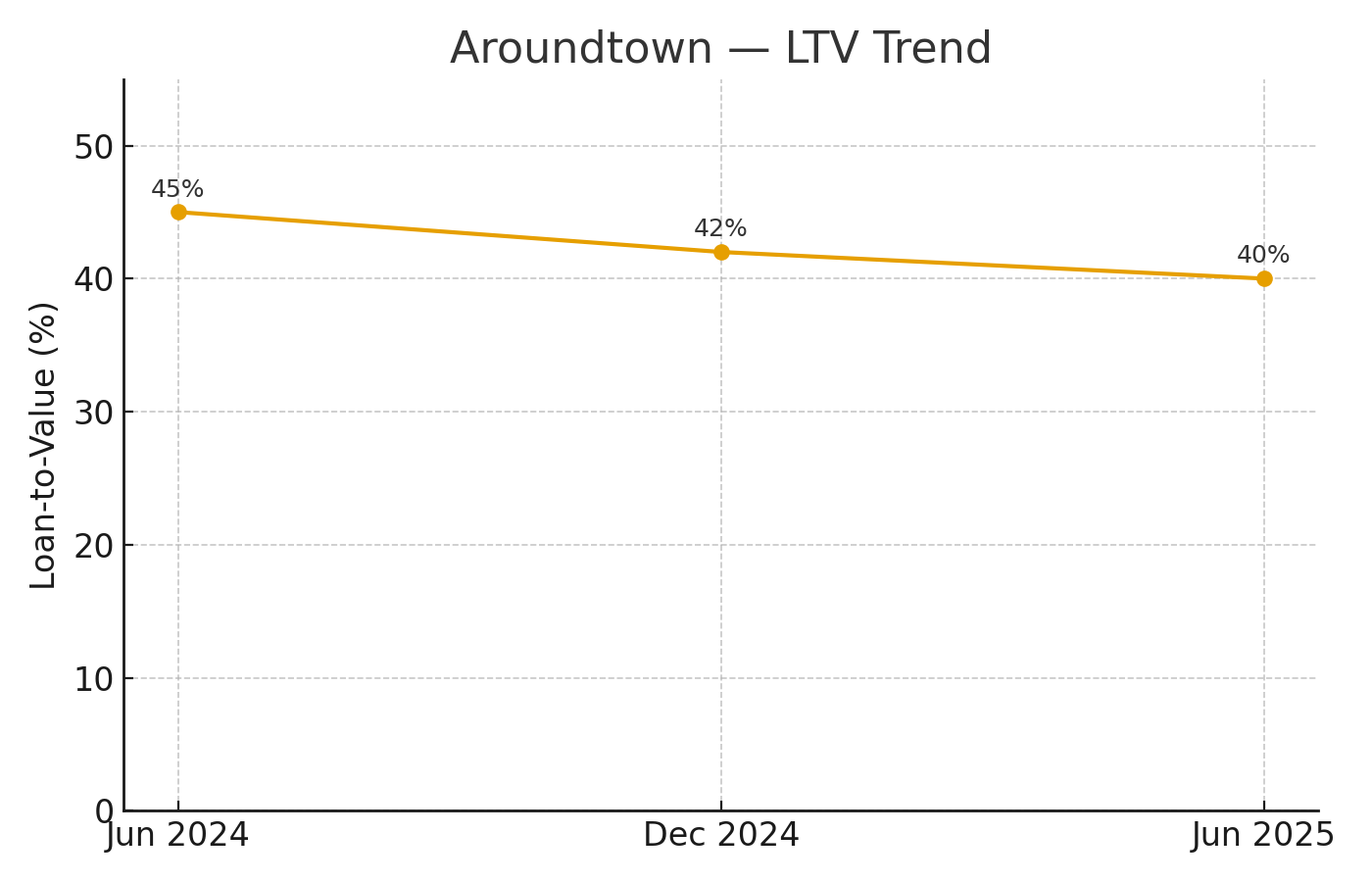

- Leverage: Loan‑to‑Value (LTV) reduced to ~40% (from 42% at YE’24) with a robust interest cover (~4.2x).

- Unencumbered pool: ~70% by rent; management cites ~€17bn of unencumbered assets, enhancing secured financing flexibility.

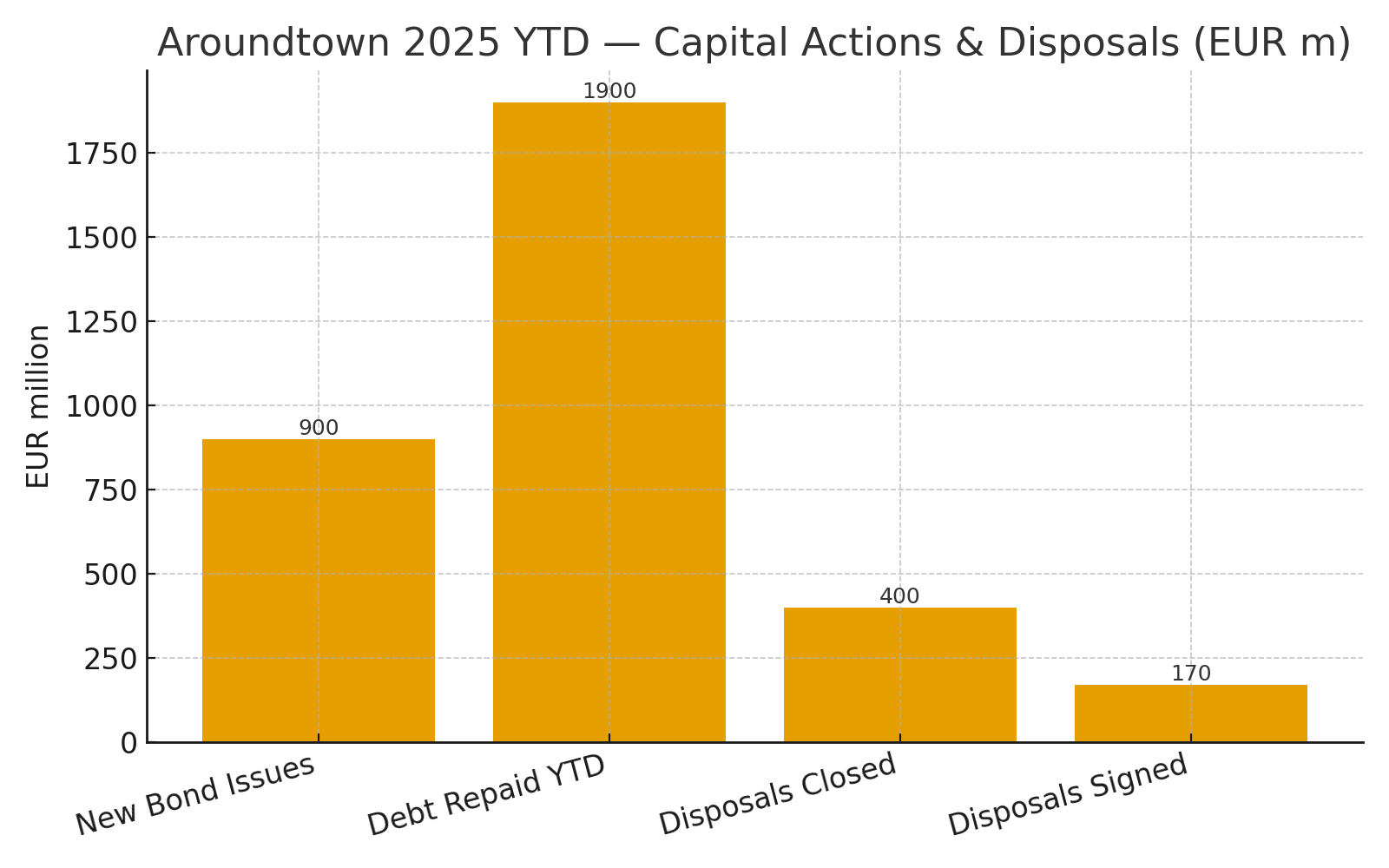

- Capital markets activity: New €750m senior unsecured bond (5‑yr) at a 3.5% coupon, plus a €150m tap post‑period; ~€1.9bn of debt repaid year‑to‑date, extending the maturity profile.

- Disposals: ~€400m closed in H1 at ~book value; ~€170m signed.

Why the Shares Fell on “Good” News

Despite positive optics (revaluation gains, lower LTV, cheaper refinancing), the equity market often discounts non‑cash valuation effects and focuses on recurring cash. FFO I edged down year‑over‑year due to perpetual note attribution, and investors remain sensitive to the refinancing cadence and office leasing risk. A long‑tenured CFO’s planned step‑down, while orderly, adds a layer of transition risk.

Strategy: From Deleveraging to Opportunistic Growth

Aroundtown signals a shift from pure balance‑sheet defense toward selective growth. Internally, this includes repositioning (e.g., hotels, office conversions) and targeted capex with attractive yields. Externally, lower leverage and ample liquidity create room for accretive acquisitions and capital recycling—provided pricing discipline holds.

Data‑Centre Optionality (Berlin & Frankfurt)

Initial grid allocations for several Berlin projects mark progress toward converting portions of office assets into data‑centre or edge/co‑location uses. Timelines will remain multi‑year given permitting and power constraints, and allocations may be below requested capacity. Management’s near‑term approach favors partial conversions that can proceed on incremental approvals while larger, full‑building conversions are pursued in parallel. This pathway can improve occupancy and NOI over time and underpins the asset‑repositioning story.

Valuation Context

Even after the bounce in EPRA NTA, the shares have recently traded at a material discount to NAV. On company‑reported figures (market capitalization excluding treasury shares vs. EPRA NTA), the implied multiple remains well below parity. As refinancing continues at lower marginal coupons and disposals clear near book, there is scope for multiple normalization.

Key Risks to Monitor

- Refinancing & spread risk: sizeable maturities every year; perpetual coupons reduce FFO attribution.

- Office demand & vacancy: leasing progress is essential to sustain like‑for‑like growth.

- Execution risk on disposals: maintaining book‑value exits at scale is crucial to keep LTV trending lower.

- Project execution: data‑centre conversions require specialist partners, capex, and dependable power allocations.

Our Take

Aroundtown’s H1 2025 shows a landlord that has stabilized its core cash flow, improved leverage, and regained unsecured market access at attractive terms. The data‑centre angle adds a credible, if gradual, route to value creation. For investors focused on European listed real estate, the setup looks option‑rich: downside cushioned by a conservative balance sheet, upside linked to execution on disposals, refinancing, and selective conversions.

Disclosure: This article is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell securities.